India is a land of two-wheelers, and despite it being the largest two-wheeler consuming country in the world, the share of motorcycles above 250 cc is quite low. For instance, out of the 1.35 crore two-wheelers sold in India in FY22 YTD, the majority were below 125 cc.

The bigger motorcycle scene in India, nonetheless, is improving. As the overall economic conditions of India (GDP, per capita income) gets better, the demand and consumption for superbikes have increased dramatically in India, noted Saurav Kumar, Managing Director, Protiviti Member Firm for India. He said, “To put this in context, as on June 2022, this segment (over 250 cc) has seen overall YTD growth of 50% as compared to last year.”

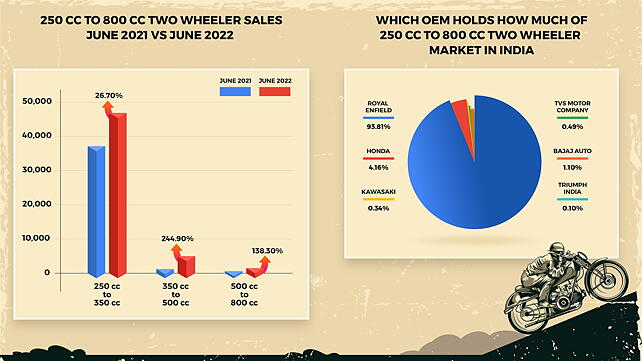

In June 2022, India saw sales of 53,853 units of bikes in the segments between 250 cc and 800 cc. In comparison, the analysed segment had seen sales of 39,149 units in June 2021. A majority of these sales came from the 250-350 cc segment with 46,948 units, followed by 5,105 units in the 350-500 cc segment, and 1,530 units in the 500-800 cc segment. These numbers have been sourced from the Society of Indian Automobile Manufactures (SIAM).

In terms of YoY growth, the 350-500 cc segment posted the highest YoY growth of 244.9%. (Fig. 1)

It must be noted that motorcycles above 300 cc add more value to the ecosystem compared to their below 125 cc counterparts. This is because components and solutions (hardware and software) developed for bigger bikes add more value to the local ecosystem than the ones developed for smaller two-wheelers, noted Atul Chandel, Director, Autobei Consultants.

“The ticket size for an auto ancillary supplying component solutions for Royal Enfield Interceptor is much bigger than the ticket size of components for a 125 cc bike,” he explained.

Will The Trend Continue?

The ‘performance’, ‘hobby’, and ‘prestige’ motorcycle segments are growing at a rapid pace, according to Anurag Singh, Managing Director, Primus Partners. These segments, he said, are less sensitive towards price and the customers want to make a statement, follow their passion and have a good ownership experience.

What's fuelling the above 250 cc two-wheeler market in India is an increase in the spending power of the consumer, affluence, and affordability. Kumar explained that people who would have settled for a much more affordable bike in the past due to limited funds are going out and getting what they want because of the increased spending power. He also noted how “second wind” desire is aiding the bigger two-wheelers market in India.

“An interesting trend is the ‘second wind’ desire within the middle-aged (40+ age group) population, who have the financial capability and a strong inclination towards purchasing these high-power bikes,” Kumar argued.

The rising popularity of superbike clubs and communities, availability of a wide range of premium motorcycle brands, and racing tournaments have also helped the segment to grow in India. Chandel is of the view that motorcycles from Royal Enfield (RE) are the key drivers of the segment. “RE's have set the context for bigger motorcycles in India. It is imperative from the numbers as well. RE dominates the market here,” he said.

As a matter of fact, out of 53,583 units sold in the 250-800 cc segment in June 2022, Royal Enfield accounted for 50,265 units, with a whopping 93.80% of the segment share! The OEM dominates all three verticals being analysed here – the 250-350 cc, 350-500 cc, and 500-800 cc.

Subhabrata Sengupta, Executive Director, Avalon Consulting, highlighted, “RE has competent products, a strong brand that it keeps reinforcing with lifestyle events, and good serviceability (as compared to premium foreign brands) with ‘bullet mechanics’ available even in small towns.”

While RE is winning hands down in these three segments, it is certain that the trend of more and more 250 cc to 800 cc two-wheelers selling in India is here to stay. Placing his bets on these segments, Kumar said the market is expected to grow at 20-25% annually. However, increasing petrol prices, inflationary pressures, and cost of ownership can act as roadblocks for this segment, he said. Chandel, on the other hand, wants to wait for a few more months to put a growth figure on the chart.

The rising number of EVs will also pave the way for a rise in sales of bigger ICE two-wheelers, feels Sengupta. He said, “As lower-end motorcycles (especially urban), which are interchangeable with scooters, move to electric, the share of bigger bikes in the overall market will increase, probably at a higher rate than absolute growth.”

Making Premium Bikes In India

One of the biggest reasons RE has been able to chart a path filled with success for its products in India is the fact that it manufactures in India. A lot of other OEMs selling two-wheelers in the 250 cc to 800 cc segment take the semi-knocked down (SKD) or completely built unit (CBU) route to bring and sell such two-wheelers to India. This results in increased prices, and given India's sensitivity to prices, the products become unattractive, noted Chandel.

Singh added, “It makes a lot of sense to make in India as import duties are high and the domestic market is quite large. The production costs are low and it is competitive to set up a base here for exports. The local industry has developed well and a big ecosystem of vendors exists. India has developed good R&D capability and a lot of motorcycles are getting designed in India. With low cost and a highly capable talent pool, it makes a lot of sense to manufacture low-volume, big bikes here. BMW, KTM, Triumph, etc. have tied up with Indian manufacturers for just that.”

The time's ripe for international OEMs to set shop in India. As a matter of fact, the likes of Europe-based Moto Morini and Zontes have recently entered the Indian market in collaboration with Adishwar Auto Ride. Benelli has also been upscaling its business in India at an impressive pace for the premium motorcycle segment by introducing two to three new models during the year and expanding dealership networks in cities.

British brand Triumph Motorcycles is targeting a market share of 25% in India’s premium motorcycle segment, which includes models having engine capacity of more than 500 cc and priced above INR 500,000.

International OEMs, Kumar noted, have been grappling to gain volumes and profitability in India due to several factors, including high operational cost and relatively high tariffs on imported premium bikes. However, other foreign OEMs like Honda, Suzuki, Triumph, Benelli, and BMW are pushing their strategy in premium bike segment through technological advancement and aggressive pricing.

Notably, the exit of a premium brand like Harley-Davidson from the market did lead to uncertainty and loss of confidence among consumers and dealers towards the existing international brands in the country. The premium brand, however, made a comeback in India through Hero MotoCorp's retail outlets.